|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding 125 LTV Refinance Lenders: A Comprehensive GuideRefinancing a mortgage can be a smart financial move, especially if you're dealing with high interest rates or need better loan terms. A 125 Loan-to-Value (LTV) refinance is a unique option for homeowners who owe more than their home’s current market value. Let’s dive into the details. What is a 125 LTV Refinance?A 125 LTV refinance allows homeowners to refinance their mortgages up to 125% of their home's value. This is particularly useful for those with negative equity, where the mortgage is greater than the home's worth. Benefits of 125 LTV Refinance

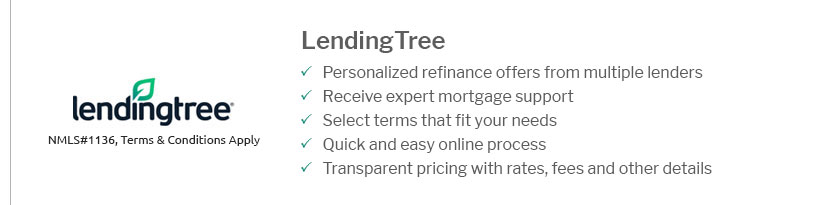

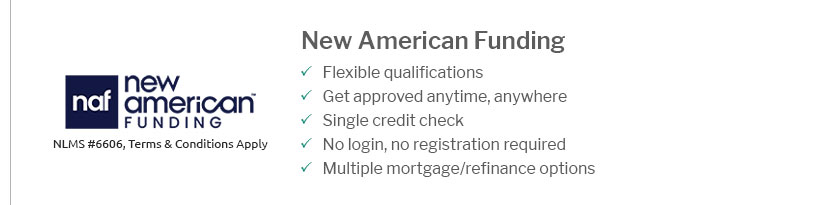

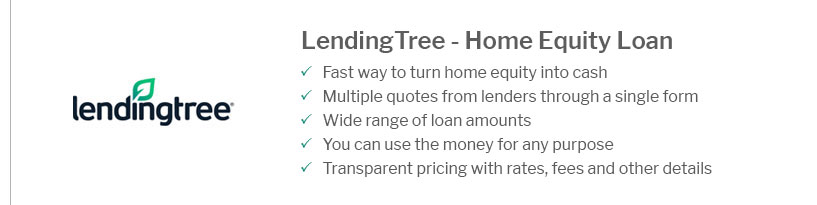

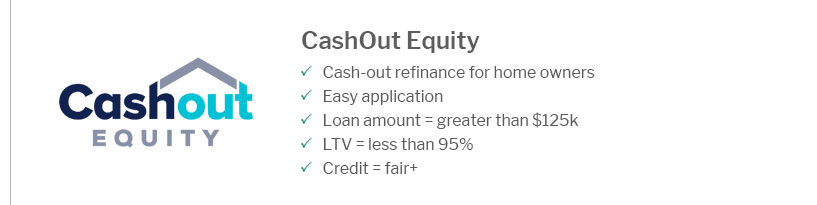

Finding 125 LTV Refinance LendersNot all lenders offer 125 LTV refinances, making it important to research and find those that do. Start by checking with your current mortgage lender, as they may have special programs for existing customers. Key Considerations

Comparing 125 LTV Refinance LendersWhen comparing lenders, consider their reputation, customer service, and the specific terms they offer for 125 LTV refinances. Look for lenders with transparent processes and favorable terms. Utilizing Online ToolsUse online resources to compare 30 year home interest rates and lender reviews to ensure you make an informed decision. FAQ SectionWhat is the main advantage of a 125 LTV refinance?The main advantage is the ability to refinance even if you owe more than your home is worth, which is beneficial for debt consolidation and improving cash flow. Are there risks associated with 125 LTV refinances?Yes, the main risk is increasing your debt burden if the home's value doesn't increase, potentially leading to financial strain if market conditions change. How do I qualify for a 125 LTV refinance?Typically, you'll need a good credit score, proof of income, and a manageable debt-to-income ratio. Each lender may have additional specific requirements. https://www.datamangroup.com/125-ltv-prospects/

Our list of mortgage prospects with 125% LTV is a narrow, responsive target of homeowners who may be great prospects for refinancing. https://www.investopedia.com/terms/1/125_loan.asp

In financing terminology, a 125% loan has a loan-to-value (LTV) ratio of 125%. The LTV ratio, which compares the size of a loan relative to the appraised value ... https://www.fedmc.com/harp-loan/

Your current loan-to-value (LTV) ratio must be greater than 80%. You must be current on the mortgage at the time of the refinance, with a good payment history ...

|

|---|